Covid 19 Business Loan Application Rbc

The financial fallout of mass social distancing. Renewal fee 0 if stand-alone CSBFL Registration Fee.

Rbc Drive App Puts Canadians In Control Of Car Records Travel Expenses

The program is available to eligible business clients that have been negatively impacted by COVID-19 and provides access to loan.

Covid 19 business loan application rbc. In recognition of the economic risks posed by the pandemic the federal government is unveiling new measures to help. One-time Federal Government registration fee of 2 of the loan amount which may be included in the amount borrowed A 125 Administration Fee is. Businesses heavily impacted by COVID-19 can access guaranteed low-interest loans of 25000 to 1 million to cover operational cash flow needs.

RBC announced today that the online-only enrollment process to participate in the Government of Canadas Canada. The Canada Emergency Business Account CEBA was created to help small businesses who are financially struggling because of COVID-19. Let us find a tailored solution just for you.

As the nation and the world grapple with the spread of COVID-19 and global economies shut down in an effort to keep people safe at home business owners are facing a crisis of their own. Royal Business Operating Line. RBC business clients who have been registered as a business.

The CERB application will be accessible through a secure web portal starting in. For instance RBC is offering a number of temporary relief solutions 1 for eligible small business and commercial clients. To apply eligible businesses and not-for-profits need to contact the financial institution that provided their initial CEBA loan and provide the appropriate information and documentation.

The Targeted EIDL Advance provides businesses in low-income communities with additional funds to ensure small business continuity adaptation and resiliency. RBC is providing support to a team of researchers at Sinai Health and the University of Toronto with funds to back the early stages of developing a blood test that can identify who is immune to COVID-19 on a mass scale. Businesses are continuing to face significant cash flow challenges and disruption to their business continuity as a result of the prolonged COVID-19.

Canadian financial institutions have reacted quickly to the changing needs of business owners and many have put relief measures in place as a means to support those financially affected by COVID-19. Access the credit you need when you need it to run your business smoothly with a line of credit. On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity.

Repaying the balance of the loan on or before December 31 2022 will result in loan forgiveness of. To qualify for the maximum forgiveness of 10000 the maximum balance. RBC Scotiabank introduce online enrollment for emergency business loans.

Access to funds through Online Banking for Business ATMs or in branch. This program is designed to help small businesses and small agricultural cooperatives who have suffered substantial economic loss due to the pandemic. An important qualification is that these businesses must be unable to secure alternative funding.

Credit lines start at 10000. The line of credit will automatically be paid down with supplemental funds from your everyday operating account. ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees.

The COVID-19 Targeted EIDL Advance was signed into law on December 27 2020 as part of the Economic Aid to Hard-Hit Small Businesses Non-Profits and Venues Act. You can apply for a CEBA loan through the financial institution where your primary Business Operating Account is held. Quotes As Canada fights a powerful second wave of COVID-19 many of our small businesses are facing immense uncertainty.

This gave lenders and community partners more time to work with the smallest businesses to submit their applications while also ensuring that larger PPP-eligible businesses. Canada Emergency Business Account CEBA interest-free loans. Businesses cannot apply independentlyfirst local county and state officials.

RBC has donated funds to The World Health Organizations COVID-19 Solidarity Response Fund. Who Can Apply for a Coronavirus Small Business Loan. Specifically on February 24 2021 at 900 am.

The EDC BCAP provides eligible mid-sized and large RBC business clients with a loan of up to 625 million to offer short-term liquidity. View all Mid and Long Term Business Loans. Loan forgiveness of 25 will apply when 75 of your maximum loan balance is repaid by December 31 2022.

TORONTO February 5 2021 - As businesses across Canada continue to manage the fallout caused by COVID-19 RBC today announced that it is now accepting applications for the Government of Canadas Highly Affected Sectors Credit Availability Program HASCAP. Answer a few short questions using Your Digital Business Advisor tool and well recommend the right products and services tailored to meet your business needs. Highly Affected Sectors Credit Availability Program HASCAP Guarantee.

The CEBA loan forgiveness amount is based on the maximum balance on the RBC CreditLine for Small Business at any time between the date of account open and June 30 2021. The Canada Emergency Business Account CEBA provides interest-free partially forgivable loans of up to 60000 to small businesses and not-for-profits that have experienced diminished revenues due to COVID-19 but face ongoing non-deferrable costs such as rent utilities insurance taxes and wages. TORONTO April 17 2020 - Today RBC announced the launch of the Government of Canadas Export Development Canada EDC Business Credit Availability Program BCAP.

Businesses can qualify for loans up to 40000 to help cover operating costs.

Credit Card Transfer Creditcard Credit Card Rewards Credit Card Creditcard Credit Card Rewards Creditcard Cr Visa Credit Card Credit Card Credit Card Visa

Credit Card Transfer Creditcard Credit Card Rewards Credit Card Creditcard Credit Card Rewards Creditcard Cr Visa Credit Card Credit Card Credit Card Visa

Newest Rbc Royal Bank Promotions Bonuses Offers And Coupons January 2021 Gobankingrates

Newest Rbc Royal Bank Promotions Bonuses Offers And Coupons January 2021 Gobankingrates

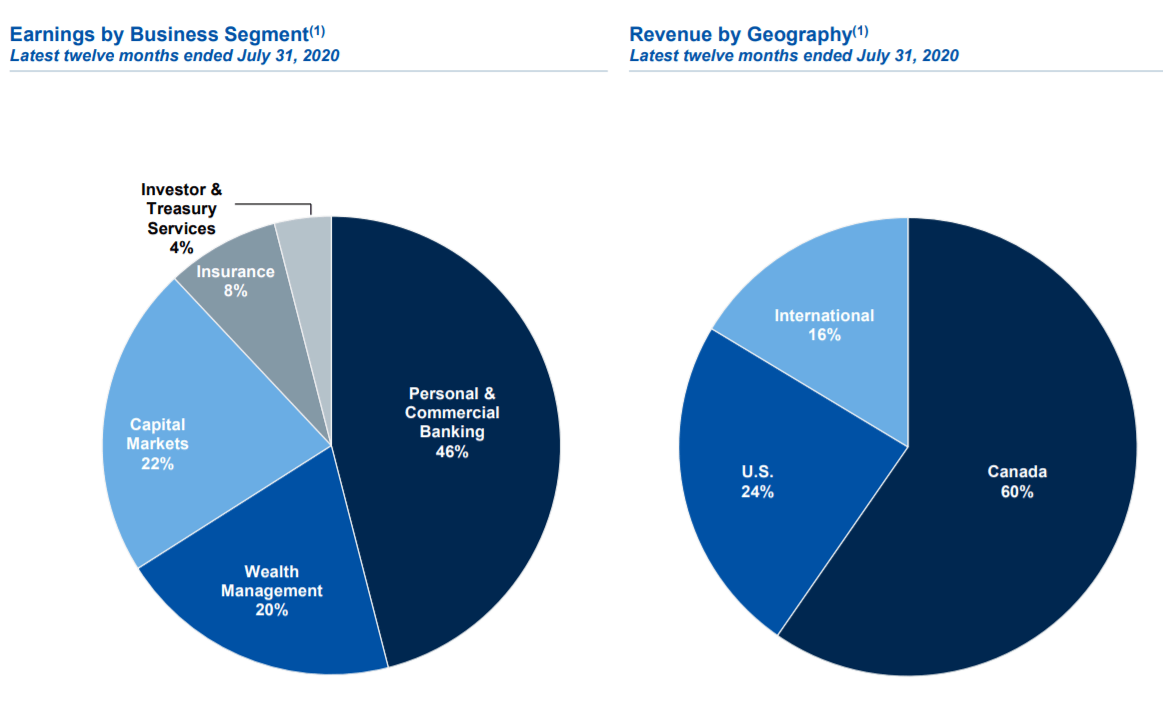

Company Insights Royal Bank Of Canada Is Reserved Boring And Copiously Profitable Nyse Ry Seeking Alpha

Company Insights Royal Bank Of Canada Is Reserved Boring And Copiously Profitable Nyse Ry Seeking Alpha

This Fintech Makes Banks Like Rbc More Profitable

This Fintech Makes Banks Like Rbc More Profitable

/https://www.thestar.com/content/dam/thestar/business/2019/08/12/rbc-analyst-charged-with-insider-trading-a-year-after-finishing-nyu-business-undergrad/rbc.jpg) Rbc Analyst Charged With Insider Trading A Year After Finishing Nyu Business Undergrad The Star

Rbc Analyst Charged With Insider Trading A Year After Finishing Nyu Business Undergrad The Star

Rbc Royal Bank Launches New Campaign To Highlight Acts Of Kindness Across The Caribbean Ieyenews

Rbc Royal Bank Launches New Campaign To Highlight Acts Of Kindness Across The Caribbean Ieyenews

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/7EIYFNKXNBHGDBWHTLHDWGEX34.jpg) Rbc Launches More Services For Clients Hardest Hit In Pandemic Using Hundreds Of Retrained Staff The Globe And Mail

Rbc Launches More Services For Clients Hardest Hit In Pandemic Using Hundreds Of Retrained Staff The Globe And Mail

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

New Rbc Research Reveals Financial Mismanagement Rising Costs As Key Impacts Of Cognitive Decline Caregiving

New Rbc Research Reveals Financial Mismanagement Rising Costs As Key Impacts Of Cognitive Decline Caregiving

How To Find And Use Your Rbc Bank Login Gobankingrates

How To Find And Use Your Rbc Bank Login Gobankingrates

Canada S Rbc To Create Us Digital Bank For Super Affluent Consumers Fintech Futures

Canada S Rbc To Create Us Digital Bank For Super Affluent Consumers Fintech Futures

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

Rbc Unveils Second Phase Of Covid 19 Relief Eye Witness News

Rbc Unveils Second Phase Of Covid 19 Relief Eye Witness News

Rbc Royal Bank Launches Second Phase Of Client Relief Options American Airlines Saint Vincent And The Grenadines Resume Services

Rbc Royal Bank Launches Second Phase Of Client Relief Options American Airlines Saint Vincent And The Grenadines Resume Services