Do I Need To 1099 My Vendors

Next you need to look at what kind of entity your vendor is. 600 or more paid in the course of your trade or business You must also file Form 1099-NEC for each person you have withheld any federal income tax box 4 under the backup withholding rules regardless of the amount of the payment.

Amazon Com 1099 Misc Forms 2020 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc 2020 Office Products

Amazon Com 1099 Misc Forms 2020 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc 2020 Office Products

All of my vendors who are 1099 eligible are not showing up on 1099 summary.

Do i need to 1099 my vendors. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. I can generate the new 1099 for the one vendor but when I go to print the 1096 it is showing all 14 vend.

Here is a further list from the IRS. I need to submit an additional 1099 that I missed when I sent in my 1096 and copies last week. If you paid anyone 600 or more youre required by US.

You will need to provide a 1099 to any vendor who is a. You will need to provide a 1099 to any vendor who is a. If you paid at least 600 yes you must issue a 1099-Misc.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. They must then also send copies of this form to their contractors subcontractors vendors and service suppliers. Transactions that were paid via credit card debit card gift card and PayPal wont be.

You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. You made the payment to someone who is not your employee.

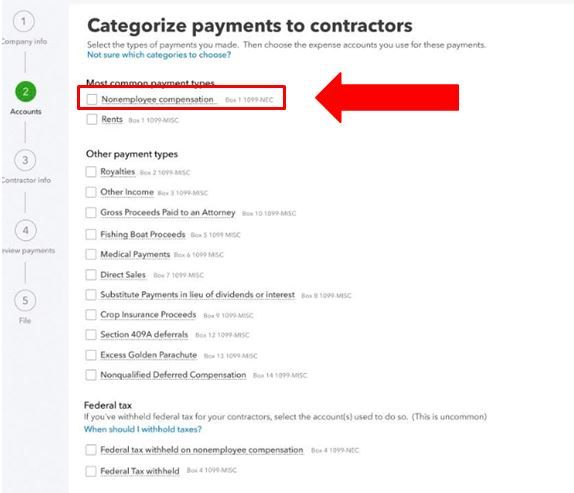

You need to file 1099 forms and have paid 1099 vendorscontractors using payment types other than cash or check such as debit card credit card or third party networking companies like PayPal. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. Hello Don12 You can report 1099s for those vendors you paid via cash or checks with a total of 600 and more.

If you paid a vendor more than 10 in interest youve got to send out a 1099-INT. The fact that you took in the gross amount on the product and then gave it to them would indicate that this would be part of their compensation. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. Its beneficial for them to sign up the free account so they can access their copies anytime they want.

However if the goods and supplies are part of the services provided by the independent contractors LLCs they would be included in the 1099-MISC form. 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. The exception to this rule is with paying attorneys.

If they are not part of the service provided you do not need to report payments for equipment supplies or. Your vendors have the option to accept or cancel the invitation. Tax law to file a 1099-MISC form.

The exception to this rule is with paying attorneys. Any business owner company or employer who secures outside services from a vendor contractor or subcontractor is required to file a 1099-MISC form with the IRS. Payments to an attorney in box 1 Attorneys fees of.

When you e-file 1099 forms through Intuit we mail a printed copy to your vendorscontractors at no additional cost. Where are instructions for vendors on how to open an account to download their 1099 forms The email to vendors has no information on this. If You Paid Someone 10 Or More For Natural Resources Forestry or Conservation Grants.

Payments found on these forms are geared towards vendors attorneys and other individuals who arent proper contractors. If you paid your 1099 recipients with only cash or check this legislation does not apply to you. Who are considered Vendors or Sub-Contractors.

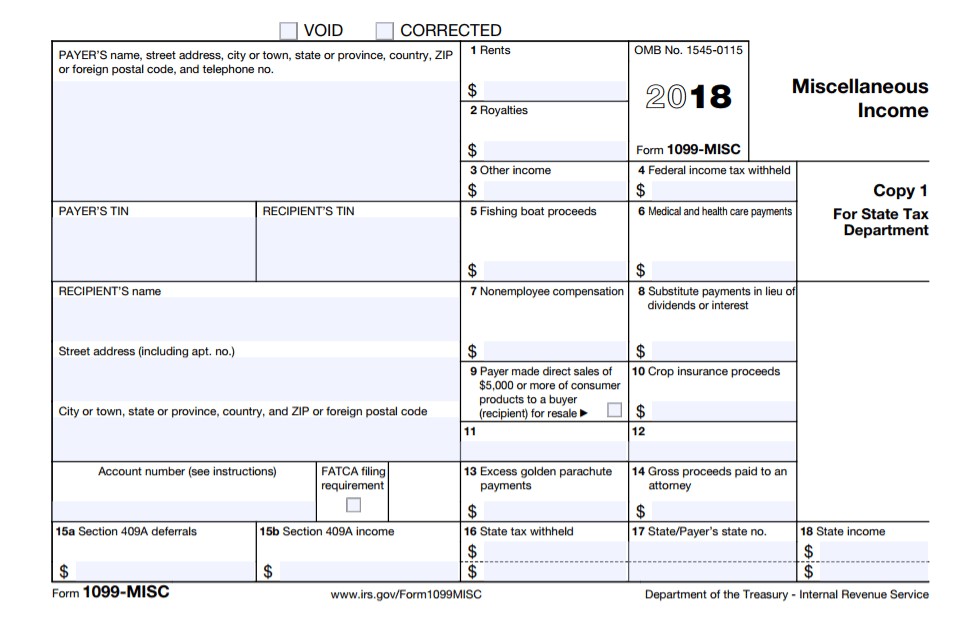

If the following four conditions are met you must generally report a payment as nonemployee compensation. They can expect their copies within 1-2 weeks after you e-file. Form 1099-MISC Miscellaneous Income.

Amazon Com New 1099 Nec Forms For 2020 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

Amazon Com New 1099 Nec Forms For 2020 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

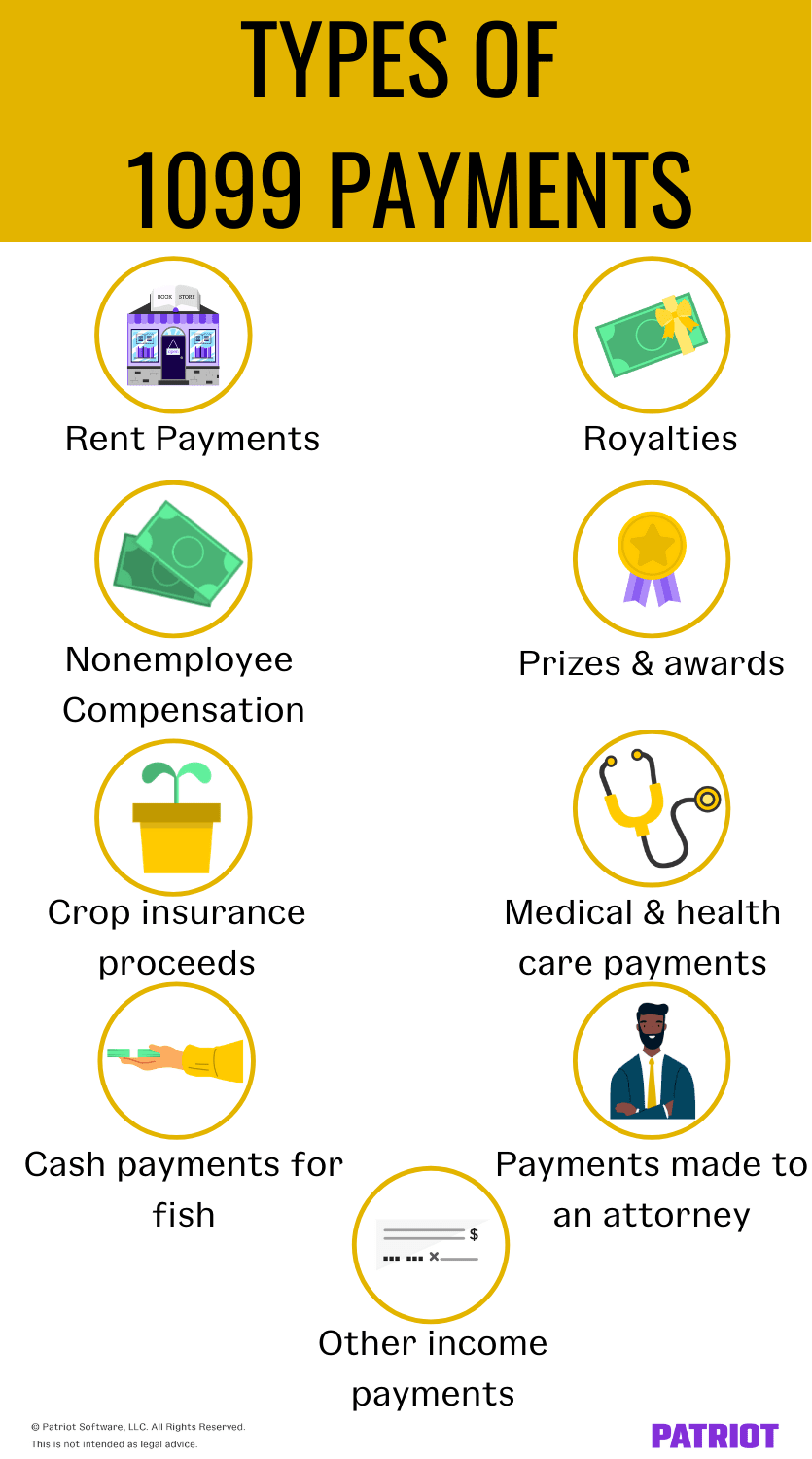

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

16 31 Complete Laser 1099 Misc Tax Form Set And 1096 Kit For 25 Vendors 5 Part All 1099 Forms In Value Pack 1099 Mi Tax Forms 1099 Tax Form Filing Taxes

16 31 Complete Laser 1099 Misc Tax Form Set And 1096 Kit For 25 Vendors 5 Part All 1099 Forms In Value Pack 1099 Mi Tax Forms 1099 Tax Form Filing Taxes

Amazon Com 1099 Misc Forms 2020 3 Part 1099 And 1096 Kit For 50 Vendors All 1099 Forms With Self Seal Envelopes In Value Pack 1099 Misc 2020 Office Products

Amazon Com 1099 Misc Forms 2020 3 Part 1099 And 1096 Kit For 50 Vendors All 1099 Forms With Self Seal Envelopes In Value Pack 1099 Misc 2020 Office Products

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

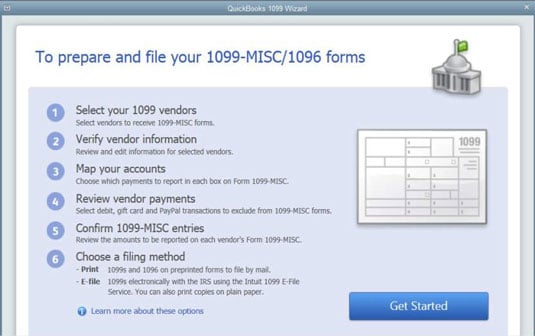

Producing 1099s For Vendors And Contractors Dummies

Producing 1099s For Vendors And Contractors Dummies

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

How Vendor Maintenance May Need To Prepare In 2020 For The Expected Irs 1099 Nec Form Irs Accounts Payable Maintenance

How Vendor Maintenance May Need To Prepare In 2020 For The Expected Irs 1099 Nec Form Irs Accounts Payable Maintenance

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose